London, UK: The first shoots of recovery for warehouse construction and automation are showing as e-commerce stabilises and companies embrace just-in-case inventory management, says a new report from Interact Analysis.

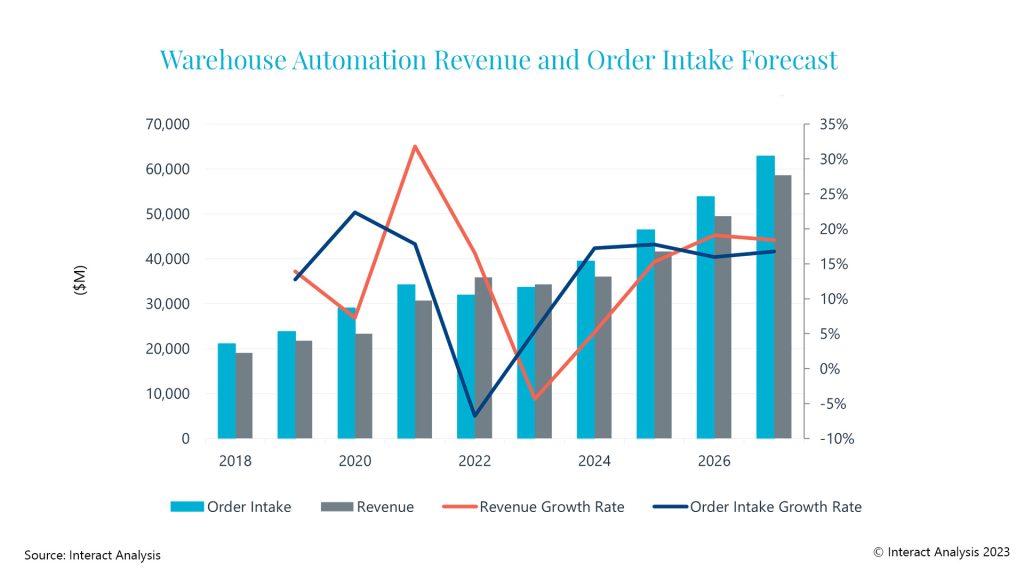

Spending on automation likely to increase in 2024 compared with this year and potentially return to double-digit growth in 2025, the report says.

“Our latest analysis indicates warehouse construction will show signs of improvement in 2024, following a projected 25% year-on-year fall in warehouses added to the building stock in 2023. The post-Covid boom in construction, driven by e-commerce activity, slowed during the last 12 months and commercial real-estate developers are seeing leaner times,” says Rueben Scriven, research manager, Interact Analysis.

“Declining growth in the e-commerce sector and rising interest rates have dampened construction, but the green shoots of recovery are starting to peek through, as previously predicted in our Q1 2023 update. As e-commerce begins to stabilize (having dipped to pre-pandemic levels it is now picking up again as a percentage of total retail sales), commercial real estate developers are expected to see more activity during 2024 and 2025.,” he says.

“With e-commerce at the tail end of the post-Covid correction, coupled with the trend away from just-in-time inventory management towards just-in-case supply chains, warehouse construction is forecast to return to growth from the end of this year, fuelling demand for automation solutions during 2024 and into 2025, particularly in the US.”

“According to the mid-year update of Interact Analysis’ latest Warehouse Automation Report, warehouse automation orders will start to increase towards the end of this year, with growth continuing in 2024, pushing automation revenue growth back into double figures in 2025. The growth of warehouse automation order intake is tightly linked to the development of new greenfield warehouse sites which are forecast to rise in 2024, following a sharp decline in 2023.”

The number of warehouses added to global building stock will drop back in 2023 before starting to recover in 2024, according to the report.